Biz2Credit

If you ever find that your business is in need of some extra funding, a business lender might be able to help. There are many different business lenders out there, all offering a range of different financial products and services from working capital loans to lines of credit, and Biz2Credit is one company we’re going to take a closer look at in this business lender review.

Biz2Credit Overview

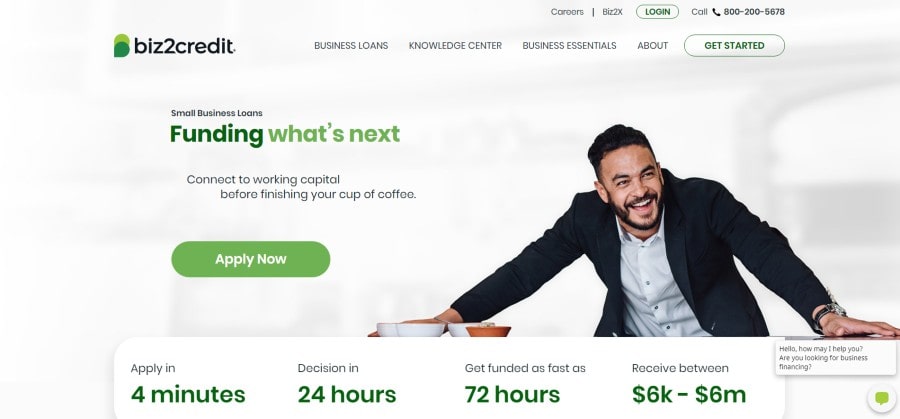

Founded in 2007 and based in New York City, Biz2Credit is an alternative lending platform specializing in providing financing and business loans to small businesses. As well as providing its own loans, Biz2Credit also works together with a range of trusted partner lenders, so if it doesn’t have the right product for you, it can still match you with another company to meet your needs. This is a nice bonus of working with Biz2Credit, as it essentially fulfils the roles of both a lender and a matchmaker at the same time.

It even offers its own free financial assistance tool called the BizAnalyzer, which helps business owners get a better understanding of their financial situation and financing options. With a quick and easy application process, relaxed requirements, and speedy funding too, Biz2Credit is very popular with many small businesses, but you need to pay attention to the terms and fees when choosing this company as they can vary quite a lot.

Back to top ↑Business Loans Offered by Biz2Credit

Biz2Credit offers the following types of financing to its customers:

- Working Capital Loans – Available on various terms, these loans are one of the most common forms of business loan and can be used for all kinds of daily costs and running expenses.

- Merchant Cash Advances – With this kind of loan, the lender will give you an advance based on the amount of sales you make in a given month. Then, you repay the loan as you make more sales.

- Additional Loans – Via its trusted partners, Biz2Credit can also help you find a range of additional business loans like long term loans and lines of credit.

Biz2Credit Details

Here’s all you need to know about how Biz2Credit business loans work:

- Applications – If you want to apply for a business loan via Biz2Credit, you’ll usually need to have at least 6 months of operations with your business and a steady stream of revenue too. Your credit score will be taken into account but Biz2Credit doesn’t reject applicants purely based on credit rating and will take other factors into account.

- Rates and Fees – Biz2Credit offers a range of different business loans and financial products from itself and its providers, so the specific terms, rates, and fees can vary quite a lot from one option to the next.

Biz2Credit Verdict

With an accessible application process, fairly relaxed requirements, and a good range of financial products to choose from, plus the option of being matched with another lender if Biz2Credit’s own offerings don’t meet your needs, this is clearly a great business lender to choose.

Back to top ↑